we are oikos.

How do we want to live, lead and learn together for a thriving, sustainable tomorrow?

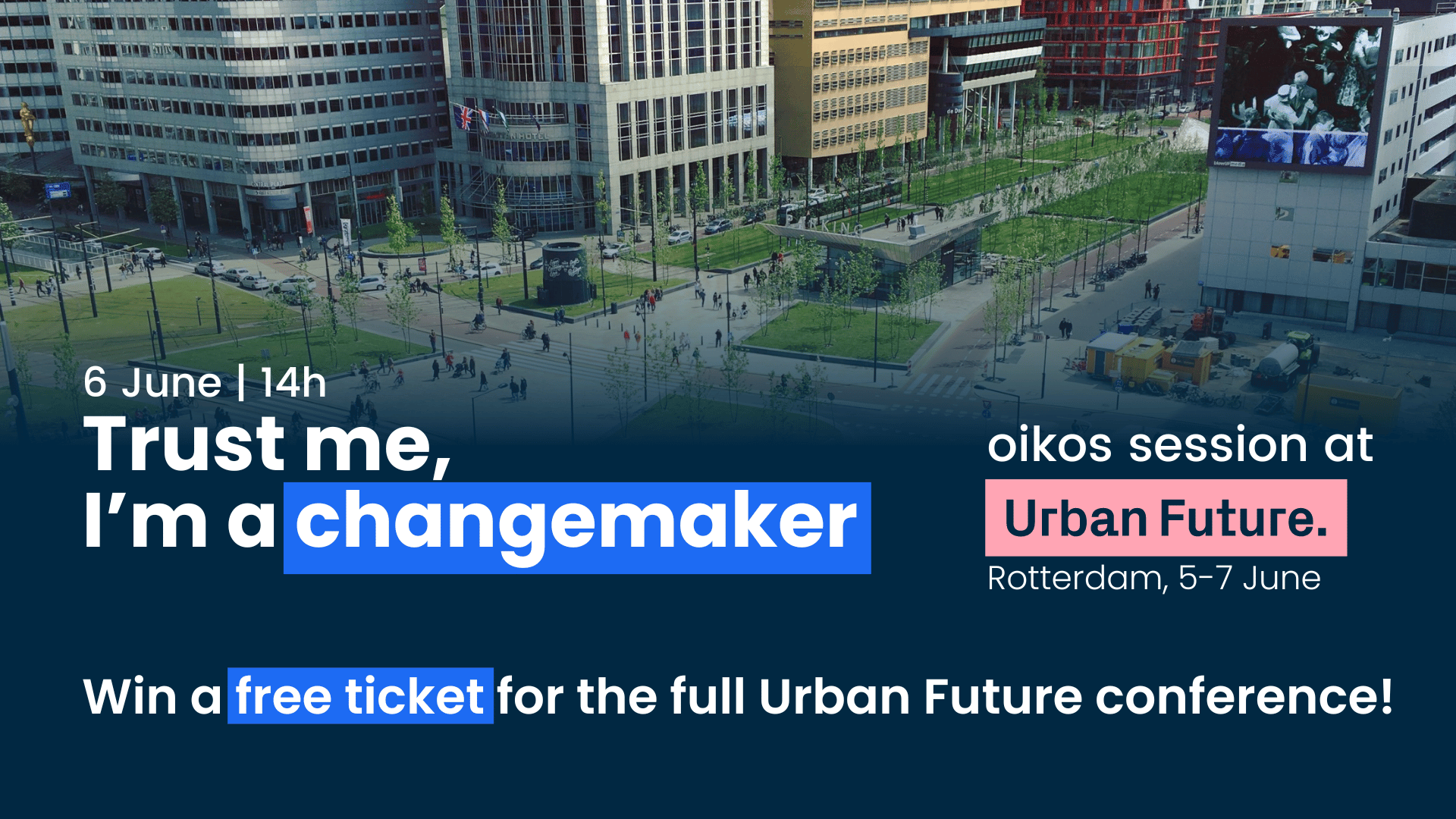

Our community of student change agents works towards transforming management & economics education for sustainability. We are walking the talk since 1987.