oikos Graz is co-organising the sustainability day at the University of Graz. More information can be found here.

oikos St. Gallen will host SUSI Partners for oikos&Pizza. SUSI Partners is a Swiss investment advisor specialized in financing the development of sustainable infrastructure, including renewable energy generation, energy...

The oikos FutureLab is the biggest event in the annual oikos calendar which gathers representatives from the entire oikos community. It provides a 2-day platform for 140 participants to...

On November 20th, 2015, 80 participants gathered at the Africa Nazarene University in Nairobi, Kenya. The morning started off with a warm welcome on behalf of the Vice Chancellor of...

Throughout the paper the author researches current economic situation of the Near East region connecting it from one side with Middle&East Asia and from other Central&East Europe highlighting the...

For investments in renewable energy consumers, electric utilities as well as private and institutional investors use a wide range of financial instruments. In the past few years, innovative models...

On a very warm, windy and pleasant Vienna day, the oikos CEE Meeting 2015 commenced. Participants travelled from more than seven countries to be united in learning more about...

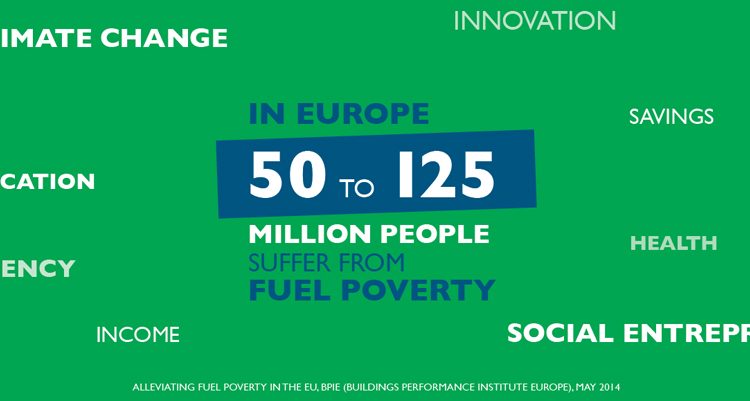

The “Social Innovation to Tackle Fuel Poverty” CHALLENGE (September 1 – October 31 2015) In Europe, 50 to 125 million persons are living in fuel poverty. Our friends...

Abstract The case study is about the dilemma faced by Dr. Jim Yong Kim (Kim), President of the World Bank Group, related to International Finance Corporation’s (IFC) funding...

Abstract In July 2012 Peter Terium was named the new CEO of RWE, the biggest electricity provider in Germany. RWE has performed financially well over the previous 40...