This month we’ve seen the United Nations Climate Change Conference (COP29) take place in Baku. It’s an important gathering of world leaders that sits them down around the question...

Abstract Shortly after the Fukushima meltdown of 2011, the Swiss government developed an Energy Strategy 2050, aimed to build up renewable energy capacity, improve energy efficiency and phase out...

On November 15, oikos Alumni came together for the fifth Alumni Debate in Zurich, Switzerland. The developments on the intersection of urbanization and digitalization were at the center of...

At the example of Daimler Trucks, this thesis aims at raising awareness for highly possible changes in the business environment of every major company that uses sophisticated logistic networks...

Abstract Socially responsible investing (SRI) is an investment process that screens investment opportunities based on ethical, social, corporate governance, or environmental. SRI has been growing rapidly; total U.S.-domiciled...

Abstract Founded in 1940, the Rockefeller Brothers Fund (RBF) is a private charitable foundation endowed with John D. Rockefeller’s heritage made in the fossil fuel sector from so...

oikos is part of the parties that signed the Open Letter on behalf of a global alliance of tertiary, higher education and student sustainability networks, associations and institutions. ...

On November 26th, 2015, 14 oikos members entered the Hall 8 of the Parc des Expositions of Paris. Coming from Germany, Switzerland, France, Austria and the UK, they were...

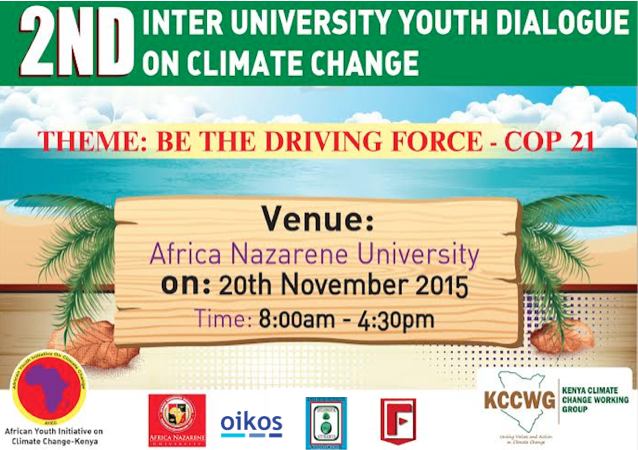

On November 20th, 2015, 80 participants gathered at the Africa Nazarene University in Nairobi, Kenya. The morning started off with a warm welcome on behalf of the Vice Chancellor of...

At the beginning of the summer, oikos joined forces with ARTE and others to create a unique video on climate change made by European citizens. The result is a...

- 1

- 2